Inflation?

My favorite radio show on NPR is Marketplace. Many stories this week have been focused on how supply chain constraints and labor shortages have resulted in prices going up. They seem to have been going up on everything: food, labor, services, hard goods, you name it. Is the inflation the pundits are talking about finally here? Is this pandemic induced or due to the government printing money? It is not yet clear whether prices are rising due to the effects of the global pandemic aftermath or the combination of quantitative easing and massive injection of cash into the economy by the US government. The headlines and store shelves, however, are clear: we are starting to see some real pricing changes upwards

- Procter & Gamble reported in April that it will raise prices in September on baby care and other products, blaming material and transportation costs.

- This week the Financial Times reported that US consumer prices increased by the most in nearly 13 years in May, 2020 compared to a year ago.

- According to the National Federation of Independent Business which released its Small Business Optimism Index this week: 40% of small business owners plan on raising prices. This is the most since 1981!

Prices are Rising!

Owners are passing the prices on as they cannot sell more to make more money. At my local Chipotle, I saw a sign this week that said that the store is raising employee wages and to accomplish this they will be raising prices on burritos, quesadillas and bowls of all kinds. There is a shortage of employees. Many workers are still having to care for children as daycare and schools are not fully reopened. Others do not yet feel comfortable to go back to a workplace where the population is not fully vaccinated. Yet another cohort of employees is receiving benefits to stay home which serves as a disincentive to return to the workforce. The situation is complicated.

Last Friday, June 4th, we received the labor report for May 2021: 559,000 jobs were created. This is a lot of jobs. However, since May of last year we have recovered only 14.7 million jobs of the 22.4 million lost last spring. We are still short about 7.6 million jobs from before the pandemic started and this shows up in the cost of rising labor. Demand has returned but supply has not. Supply chains globally were stretched and are still backed up. Labor constrained factories are recovering from shutdowns, third and fourth waves of the virus, and various government responses and policies. There are shortages of everything, from pork to latex gloves, manufacturing to trucking, lumber to steel.

Effect on New Construction

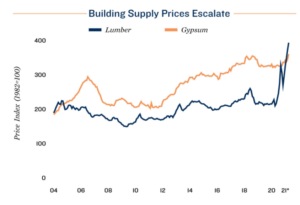

Hiring in the construction sector as of April, 2021 was within 3 percent of the pre-pandemic level. This has created skilled labor shortages in the Midwest, Southeast and other parts of the country. Property managers are losing maintenance staff who can get sign-on bonuses for simply showing up to a construction site. Construction labor costs are escalating. The Wall Street Journal reported recently that the price of softwood lumber has jumped 83 percent, steel rose 67 percent, gypsum, the primary ingredient of drywall is up 12 percent. The price of fuel and copper have increased 25 to 30 percent over the past year. According to the National Association of Home Builders (NAHB), the price of framing lumber has more than tripled over the past 10 months. These are the largest increases since 1988.

As someone who is completing a building construction project this month I am painfully aware of how these shortages affect project completion. Sherwin Williams, a major supplier of paint and coating materials including vinyl plank flooring, had to switch its supply chain out of China to South Korea and Vietnam due to the Trade War with the US last year. Now factories in Korea are struggling to keep up with production pace. A slow vaccine rollout due to vaccine shortages and shipment delays complicated South Korea’s efforts to subdue the latest wave of infections. Our floors were one of the inputs which was late in getting to us, which prolonged our build schedule. Overall result: building today becomes more expensive.

Existing housing prices and new home prices set a record last. Robust demand for homes amid a tight supply of available inventory helped push the median price of an existing residence up 20.3 percent year over year to a new high of $345,900 in April. The average days on the market is 17, down from 27 during the same period last year, and most homes are selling above asking price. While single family prices are setting record highs a number of large construction projects are getting cancelled as input costs exceed budgets which were put in place 12 to 18 months ago. According to the jobs report construction is the one area that actually shed jobs nationally in May. This is likely the result of these cancellations. Increased lumber cost add about $8,900 per unit to the price of new apartment construction. That equates to more than a million dollars on a 120-unit project. Cost increases such as these cause profit margins to shrink and make many new construction projects no longer economically viable. If there are enough cancellations of big construction projects it will inevitably lead to a slowdown in new construction.

Effect on Existing Apartment Building Inventory

Meanwhile population growth marches on. Preliminary data from the 2020 Census shows that the US population grew by about 7.4% between 2010 and 2020. While this growth is relatively slow compared to where we have been historically we cannot ignore the fact that the country added more than 22.5 million people in the past 10 years. All of these people will have to live somewhere. This population growth, combined with a slowdown in new apartment building construction creates a lopsided supply demand equation for apartments. Existing apartment buildings are in ever higher demand as home ownership becomes more expensive and out of reach for many.

Effect on Apartment Building Investors and Syndicators

As an investor in apartment buildings rising demand and constrained supply puts you in a favorable position. Investors who focus on buying property below replacement cost, in parts of the country that have strong local economies, and positive demographic trends, will earn above average returns on their investment with lower than average risk. One has to remember that loans on real estate are typically locked at a fixed interest rate for a period of anywhere between 5 and 35 years. This limits the effect of the increasing cost of debt. Rents on the other hand are very much driven by supply and demand. As the population grows and supply remains relatively constrained, rents rise. As prices on everything rise due to money supply, rising wages, and inflation in general, rents rise further still. Investing in real estate and particularly in multifamily apartment buildings is a shrewd investment hedge. It is estimated that the leap in the prices of building supplies in the past 12 months has added $119 to the monthly rent of an apartment.

Invest With US

Most individual investors with multifamily assets in their portfolio do so through partnerships with firms such as ours. Cape Sierra Capital offers investors access to invest in multifamily properties in select markets. We handle every detail, from sourcing to purchase and management.

Click here to join our Exclusive Investor Network!

Sources: Wall Street Journal, NPR Marketplace, U.S. Census Bureau; Wells Fargo, Marcus & Millichap Research Services; Capital Economics; Moody’s Analytics; Mortgage Bankers Association; National Association of Realtors; National Association of Home Builders